As part of the VAT procedure ZATCA (Zakat, Tax, and Customs Authority of Saudi Arabia) introduced E-Invoicing in the year 2021. Electronic invoicing is a procedure that aims to convert the issuing of paper invoices and notes into an electronic process that allows the exchange and processing of invoices, credit notes & debit notes in a structure electronic format between buyer and seller through an integrated electronic solution.

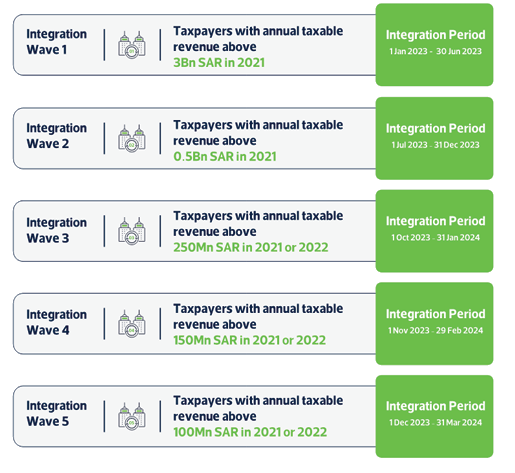

E-Invoicing procedures are implemented in two Phases. The first phase effective from December 4, 2021, with a limited set of requirements. The second phase is in the process of implementation, as mentioned in the chart given here.

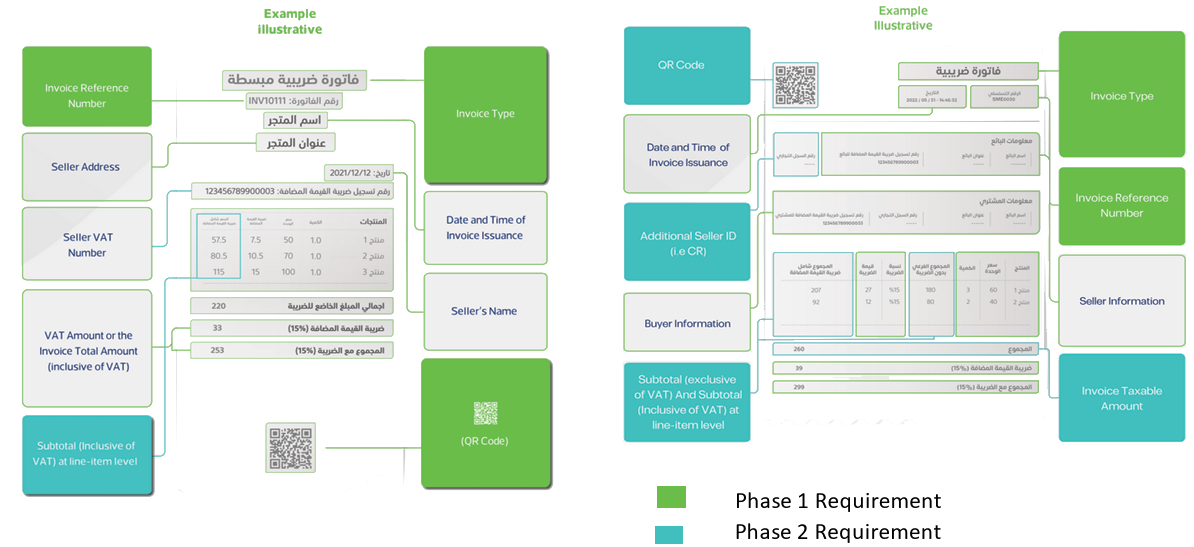

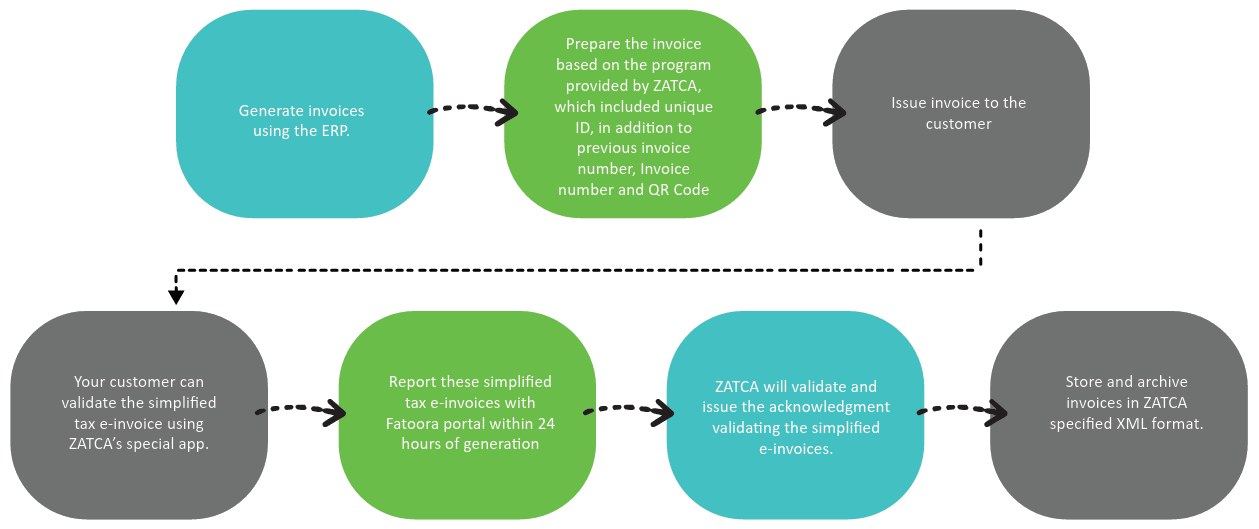

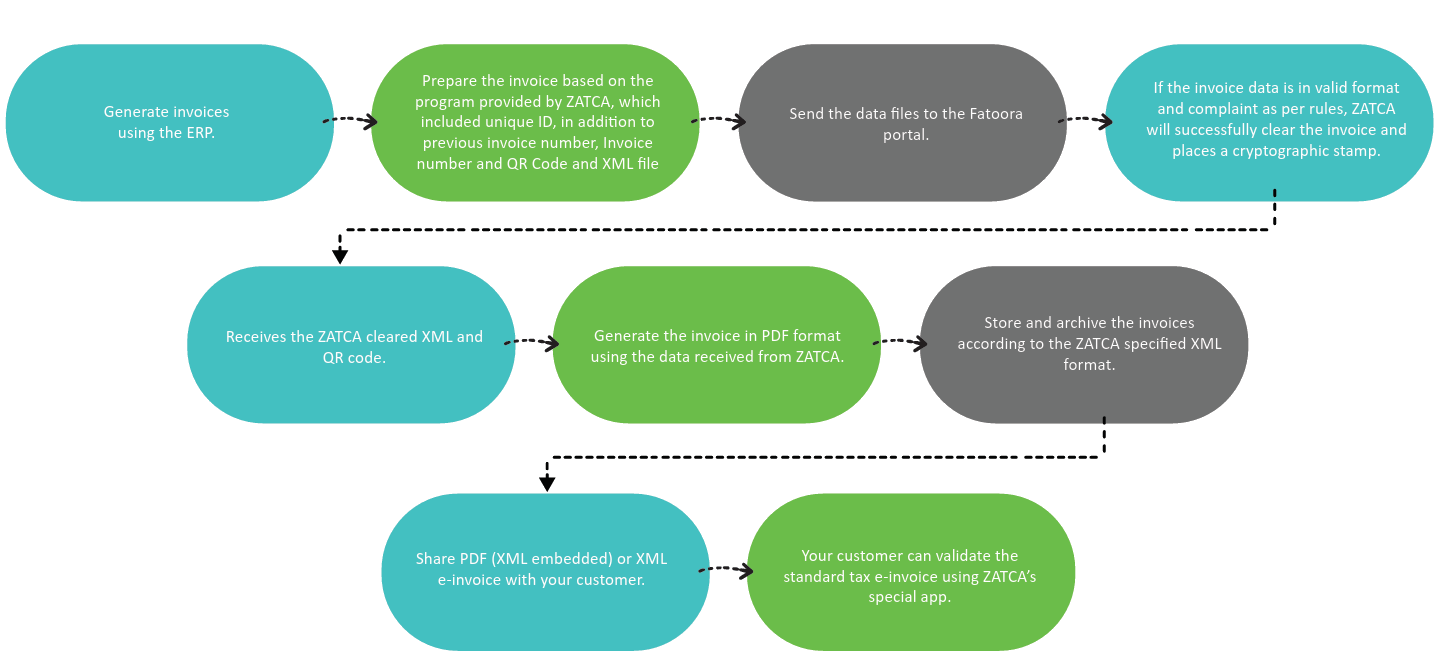

E-Invoice can be classified into two categories, Simplified Tax invoice ( Business to Consumer Invoice of less than 1,000 SAR ) and Tax Invoice ( Business to Business Invoice / invoice value of more than 1,000 SAR ).

We can provide you customized ZATCA Phase 2 invoicing solution to meet your business requirement, which can be uploaded to the existing ERP or can be integrated with that. We can provide the invoicing solution for manufacturing industry, wholesale business, retail business, pharmacy, clinic, hospital, school and many other business segments at an affordable cost.